Your Hive for Unbiased Financial Buzz

Make smarter financial decisions with BudgetBee. We provide clear, unbiased guidance on credit cards, budgeting, and personal finance – no sign-ups, no hidden agendas, just honest advice to help you thrive financially.

Start Your Journey

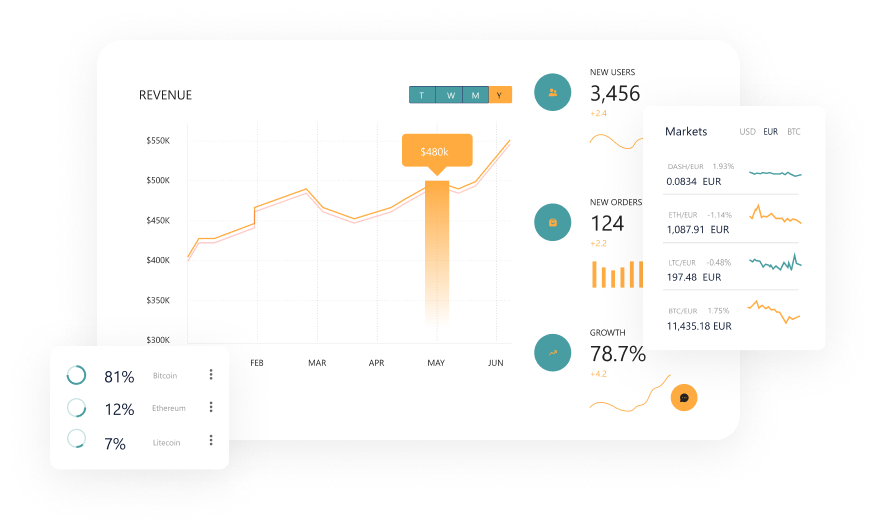

Find the Perfect Credit Card for Your Lifestyle

Navigate the overwhelming world of credit cards with confidence. We analyze hundreds of options to recommend cards that actually match your spending habits and financial goals. Whether you're building credit, maximizing rewards, or consolidating debt, we'll help you find the right fit – without the sales pitch.

Start Your Journey

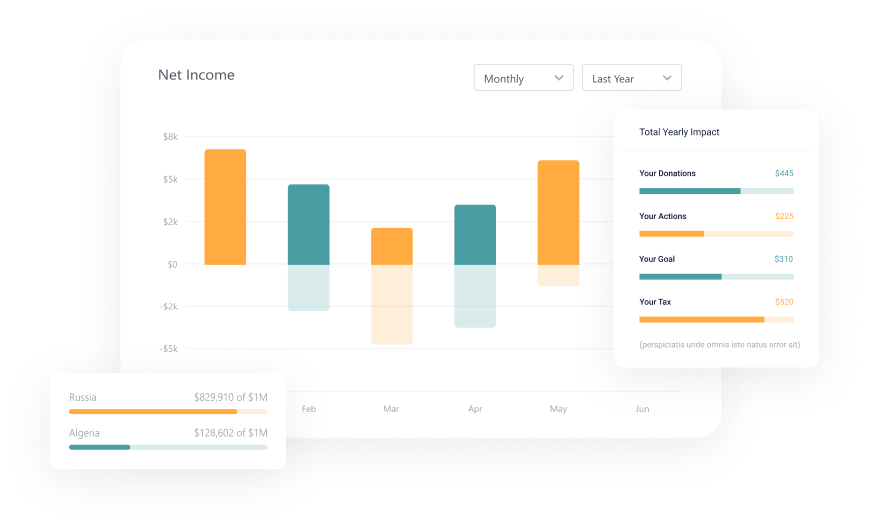

Master Your Budget Without the Stress

Budgeting doesn't have to be complicated or restrictive. Learn practical strategies that work with your lifestyle, not against it. From the 50/30/20 rule to zero-based budgeting, we break down different approaches so you can find what clicks for you. Plus, discover the best free tools and apps to automate your financial success.

Learn Budgeting BasicsLatest News

Stay informed with our latest financial insights and tips to help you make smarter money decisions.

The 50/30/20 Rule Explained: Simple Budgeting That Actually Works

If budgeting feels like solving a complex math problem every month, you're not alone. Many people struggle with creating and sticking to a budget because traditional methods can feel overwhelming. Ent

Read MoreEmergency Funds in Personal Finance: What They Are and Why You Absolutely Need One

An emergency fund is one of the most boring ideas in personal finance—until the day you actually need it. Then it becomes the hero that keeps a flat tire from turning into credit card debt, or a s

Read MoreBudgeting Methods Compared: Which Approach Fits Your Spending Style?

Creating a budget is a cornerstone of effective personal finance, but the idea of tracking every single dollar can feel daunting. The good news? There isn't one single "right" way to budget. Different

Read MoreFeatured Article

Dive deep into our most impactful financial guide this month.

The 50/30/20 Rule Explained: Simple Budgeting That Actually Works

If budgeting feels like solving a complex math problem every month, you're not alone. Many people struggle with creating and sticking to a budget because traditional methods can feel overwhelming. Enter the 50/30/20 rule—a simple, straightforward approach to personal finance that takes the guesswork out of budgeting. This beginner-friendly method helps you allocate your income effectively without

Read Full ArticleFeatured Posts

Explore our hand-picked articles to help you build better financial habits.

Emergency Funds in Personal Finance: What They Are and Why You Absolutely Need One

An emergency fund is one of the most boring ideas in personal finance—until the day you actually need it. Then it becomes the hero that keeps a flat tire from turning into credit card debt, or a s

Read MoreBudgeting Methods Compared: Which Approach Fits Your Spending Style?

Creating a budget is a cornerstone of effective personal finance, but the idea of tracking every single dollar can feel daunting. The good news? There isn't one single "right" way to budget. Different

Read MoreBuilding Good Money Habits: Consistency is Key

When it comes to managing your money, big, drastic changes often feel overwhelming and are hard to stick with. The real power lies in consistency – making small, smart financial decisions regularly. T

Read More

How BudgetBee Helps You Win Financially

Three simple steps to better financial decisions: Learn from unbiased guides, Apply practical strategies to your life, and Grow your financial confidence. No complex systems, no expensive courses – just straightforward advice that works.

Ready to Take Control of Your Finances?

Join thousands of Gen-Z and Millennials who are making smarter money moves with BudgetBee. Start exploring our unbiased guides and practical tips – no sign-up required.

Browse Financial Guides