Understanding Your Paycheck: Taxes, Deductions, and Net Pay Explained

Getting your first paycheck (or even your tenth!) can be exciting, but looking at all the numbers and abbreviations can also be confusing. You see your gross pay – the total amount you earned – but the money hitting your bank account, your net pay, is significantly less. Where did it all go? Understanding your paycheck is a fundamental part of managing your money effectively. This guide will break down the common elements of a U.S. paycheck, explaining taxes, deductions, and how your net pay is calculated.

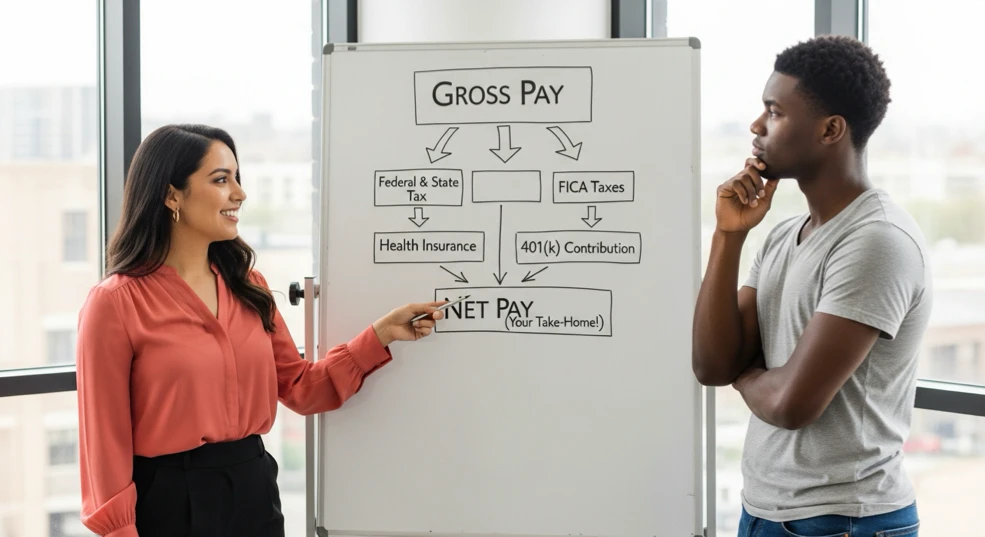

Gross Pay vs. Net Pay: The Big Picture

Before diving into the details, let’s clarify the two main figures on your paycheck:

- Gross Pay: This is your total earnings before any money is taken out. If you’re paid hourly, it’s your hourly rate multiplied by the number of hours worked. If you’re salaried, it’s your annual salary divided by the number of pay periods in a year.

- Net Pay: This is the amount of money you actually receive after all taxes and deductions have been taken out. This is often referred to as your “take-home pay.”

The difference between your gross pay and your net pay is the total amount of money withheld from your earnings. Understanding these withholdings is key to smart financial planning.

Knowing what’s being taken out of your paycheck helps you budget accurately and plan for your financial goals.

Taxes: The Non-Negotiable Deductions

A significant portion of your gross pay goes towards taxes. These are mandatory contributions to federal, state, and sometimes local governments.

- Federal Income Tax: This is a tax on your earnings collected by the U.S. government. The amount withheld depends on your income level, filing status (single, married, etc.), and the information you provided on your W-4 form when you started your job.

- State Income Tax: Most states also have an income tax. The amount varies significantly by state, and some states have no state income tax at all.

- Local Income Tax: A few cities or localities may also impose a local income tax.

- FICA Taxes: This stands for the Federal Insurance Contributions Act and includes two separate taxes:

- Social Security Tax: This tax funds retirement, disability, and survivor benefits. As of 2025, the rate is 6.2% of your gross pay up to a certain annual income limit.

- Medicare Tax: This tax funds health insurance for seniors and individuals with disabilities. As of 2025, the rate is 1.45% of your gross pay with no income limit.

Your employer also pays a matching amount for Social Security and Medicare taxes.

Other Common Paycheck Deductions

Beyond taxes, there are other amounts that might be deducted from your paycheck. Some are mandatory, while others are voluntary based on benefits you’ve elected.

- Health Insurance Premiums: If your employer offers health insurance and you enroll, your share of the premium is typically deducted from your paycheck.

- Retirement Contributions: If you contribute to a retirement account like a 401(k) through your employer, your contributions are deducted. These contributions are often pre-tax, meaning they reduce your taxable income. Saving for retirement early is a smart financial move; learn more about choosing the right retirement account.

- Other Insurance Premiums: Deductions might also include premiums for dental, vision, life, or disability insurance if you’ve opted for these benefits.

- Wage Garnishments: In some cases, money may be legally withheld from your paycheck due to court orders, such as for child support or unpaid taxes.

- Other Voluntary Deductions: This could include deductions for things like a Flexible Spending Account (FSA), Health Savings Account (HSA), or contributions to other employer-sponsored programs.

Understanding these deductions helps you see the full value of your compensation package, not just your salary. For instance, employer contributions to health insurance or retirement are valuable benefits that don’t show up in your gross pay but are part of your overall earnings.

Calculating Your Net Pay

Your net pay is simply your gross pay minus all the taxes and deductions.

Gross Pay - Taxes - Deductions = Net Pay

For example, if your gross pay for a pay period is $1,500, and $300 is withheld for federal and state income taxes, $114 for FICA taxes, and $50 for health insurance, your net pay would be:

$1,500 (Gross Pay) - $300 (Income Taxes) - $114 (FICA Taxes) - $50 (Health Insurance) = $1,036 (Net Pay)

This is the amount that will be deposited into your bank account. Keeping track of your income and expenses is crucial for managing your net pay effectively. Consider using tools or methods for effective budgeting to make the most of your take-home pay.

Conclusion: Take Control by Understanding Your Paycheck

Your paycheck is more than just a number; it’s a detailed breakdown of your earnings and how they are allocated. By taking the time to understand the taxes and deductions, you gain clarity on your true take-home pay and can make more informed decisions about budgeting, saving, and spending.

Credit Cards to Complement Your Paycheck Management

While credit cards don’t directly impact your paycheck deductions, using them strategically can help you manage your net pay and optimize your spending.

- For maximizing rewards on everyday spending: If you pay your balance in full, a rewards card can provide cashback or points that can effectively increase your take-home value. Consider the Citi Double Cash Card for a straightforward 2% cashback on all purchases.

- For managing large expenses: If you have a large, planned expense that exceeds your immediate net pay, a card with a 0% introductory APR on purchases can help you spread out payments without incurring interest. The Chase Freedom Unlimited Credit Card offers this benefit.

- For building credit for future financial stability: A strong credit score, built through responsible credit card use, can lead to better rates on loans or mortgages in the future, indirectly impacting your long-term financial health. The Visa Signature U.S. Current Build Credit Card is designed for credit building.

Don’t let the jargon intimidate you. Each line item represents a part of your financial picture. Understanding it is a powerful step towards taking control of your personal finances and building a secure future. Make it a habit to review your paycheck regularly and ask questions if something is unclear. Once you understand your income, you can better plan for setting financial goals and building good money habits.